Average tax deduction from paycheck

The statewide sales tax is 7 and the average effective property tax rate is 081. And prices have risen 25 percent since then according.

Different Types Of Payroll Deductions Gusto

The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction.

. State share of national SALT deductions. From Paycheck to Purpose Book. Certain itemized deductions including property tax qualified charitable contributions etc may be allowed depending on.

The average amount spent was higher at 529 for teachers at city schools. Starting with the 2018 tax year the maximum SALT deduction available was 10000. According to the IRS over 247 million tax refunds were issued in fiscal year 2021 and the average refund was 2959.

The IRS has a few limits and. Michigan has no standard deduction. Indiana has a flat statewide income tax.

But you may be eligible for a tax deduction. And the average annual cost is around 1000. Tax withheld to date or per paycheck.

So not only are they ineligible for a tax write-off theyre only going to be more of a budget buster as time goes by. Your paycheck needs protection. However many counties charge an additional income tax.

However they are not typically considered pretax so theyre taken out of your paycheck based on the amount you make before the money is taxed. However it may provide even more value spread out throughout the year rather than receiving it all at once. For example lets say your employer-sponsored health insurance costs 250 each month and you earn 4500 each month.

1 In case you havent noticed fees tend to rise by 5 a year. In 2017 this rate fell to 323 and remains there through the 2021 tax year. The state and local tax deduction or SALT deduction for short allows taxpayers to deduct certain state and local taxes on their federal tax returns.

The average local income tax collected as a percentage of total income is 013. The average amount spent during the 2014-2015 school year was 478. Average amount of SALT deduction.

The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns. This windfall at tax time can be handy. That 250 would be pulled for your insurance payment and youd pay taxes.

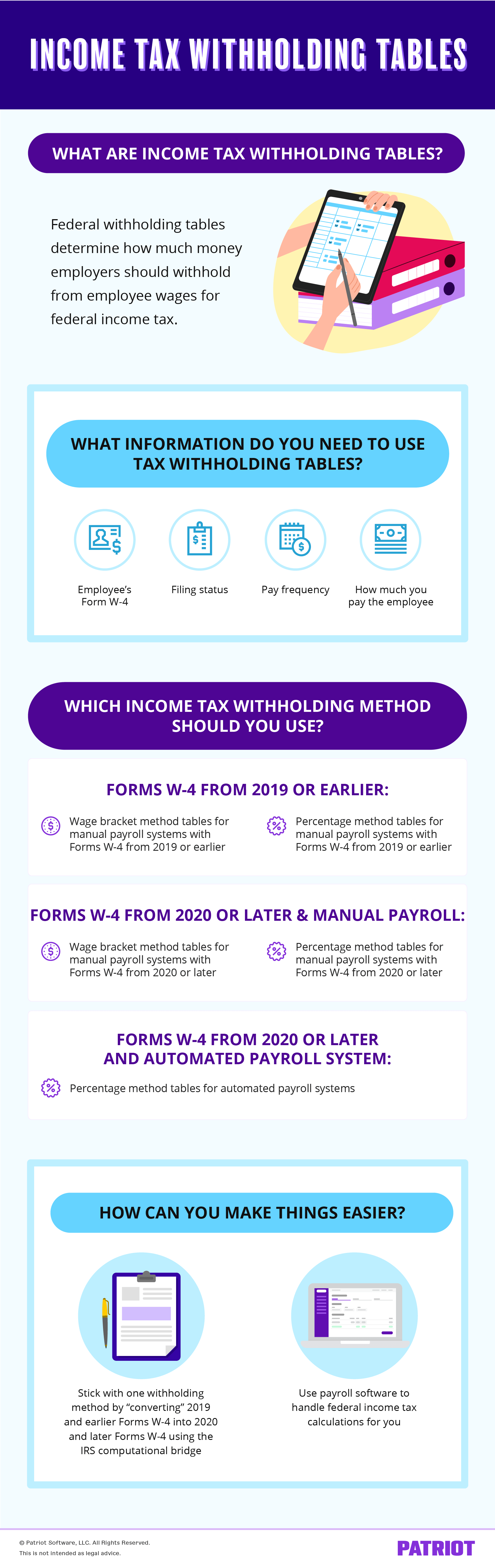

2022 Income Tax Withholding Tables Changes Examples

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

Pin On Free Salary Slip Template

Policy Basics Federal Payroll Taxes Center On Budget And Policy Priorities

Payroll Tax What It Is How To Calculate It Bench Accounting

4 Things To Know To Complete Trust Returns Trust Things To Know Deduction

2022 Federal Payroll Tax Rates Abacus Payroll

Pin Page

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Pin On Tax News And Blog Posts

See How Your Spending Compares To The Average Joe S Spending Money Spending Habits Spending

Mary Kay Marketing Plan Sheet Perfect For Team Building Opportunities Find It Only At Www Thepinkbubble Mary Kay Marketing Mary Kay Business Selling Mary Kay

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

2022 Federal State Payroll Tax Rates For Employers

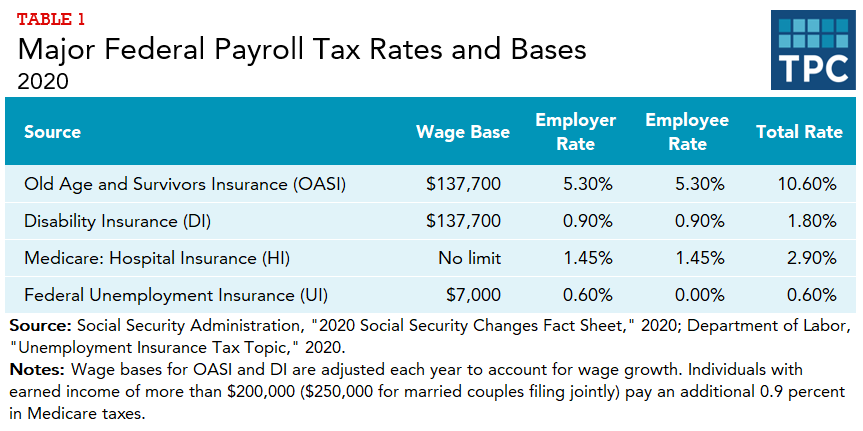

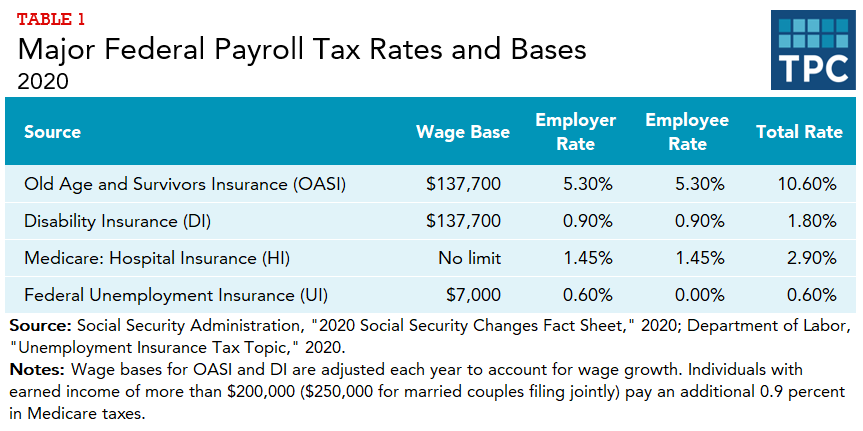

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Traditional Vs Roth In Detail I Need To Know Tax Money Paying Taxes

Payslip Templates 28 Free Printable Excel Word Formats Excel Excel Templates Templates